As part of the series of insights around our 2023 Digital & Tech Salary Survey, we have analysed the current UK hiring market to understand the trends, challenges and opportunities for the year ahead. Read on for our UK market insights and overview.

Overview

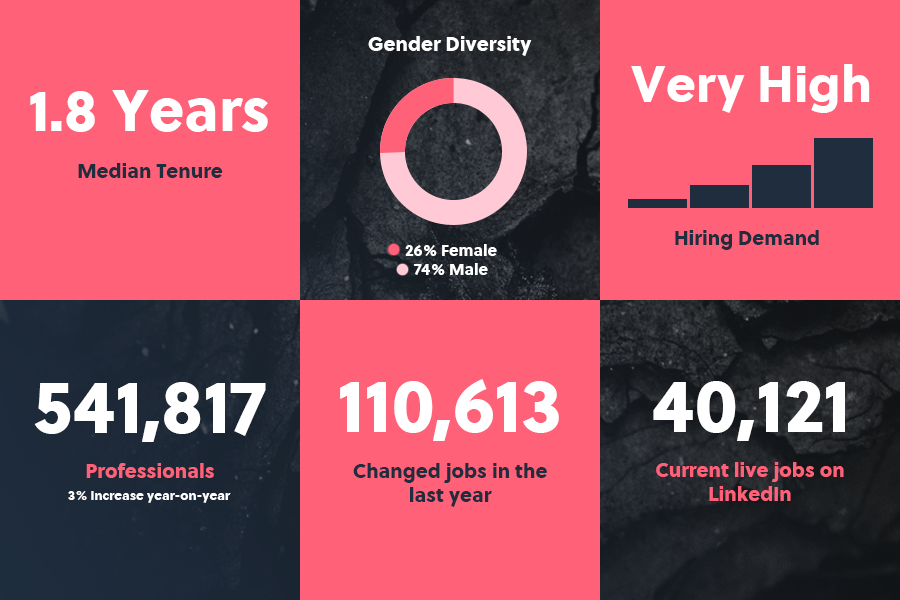

2022 saw huge demand for hiring in the digital and tech sector and, like many other industries, demand has outstripped supply. The median tenure of professionals within the industry indicates how buoyant the market is, with the majority of professionals in the sector seemingly making a career move in recent months. The degree of chopping and changing that we are seeing could be attributed to trends and changes within the industry itself: technology is ever-evolving, and businesses must adapt to these changes by ensuring they have a workforce that is equipped to keep up with them.

When we look at the number of professionals who have changed roles in the past year alone, we can see that 20% have made a change. Post-covid, many lifestyles have changed; consumer habits have altered, and we have seen huge steps forward for the tech industry, rather than a reversion to pre-covid norms. In turn, salaries have had to increase to keep up with this demand. Therefore, it makes sense that a high volume of professionals in the industry have started a new role since the pandemic, given that the landscape of the industry has changed so much.

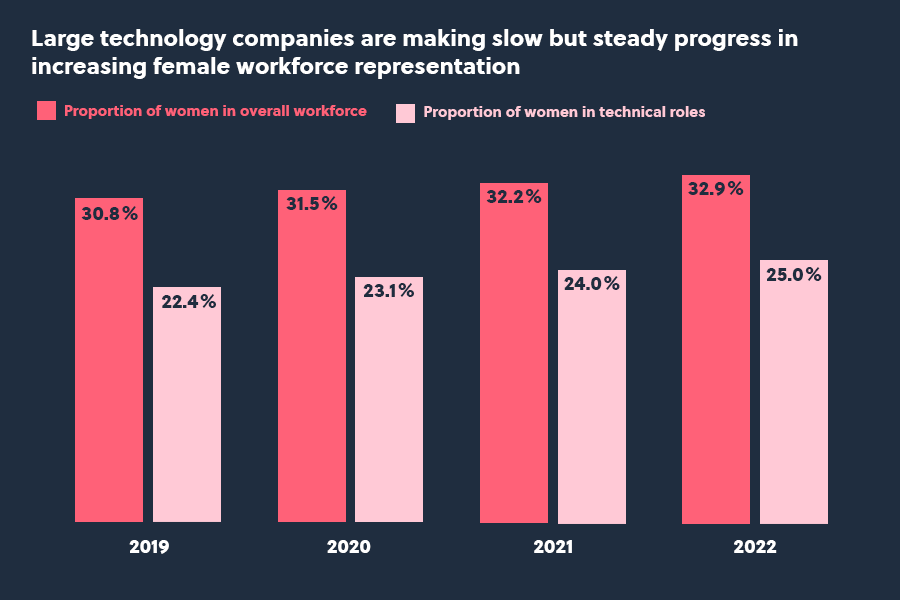

It’s clear that gender diversity within the workforce still needs more work, with the gender makeup in the sector reflecting a clear male dominance. Although there has been some improvement in gender diversity in the workforce, this progress has been incredibly slow, as reflected in the graph below from Deloitte’s analysis of large tech companies. There should be a sector-wide focus on increasing the momentum of diversity in business recruitment strategies for the year ahead to tackle this disparity.

Top Locations

As an industry, Digital and Tech were already relatively well-established as remote-workers and were more equipped to offer this option to their workers prior to the onset of the pandemic. Arguably as a result of this, the changes that covid wrought for many businesses were not as seismic in tech as in other industries. This could be one of the reasons why we haven’t seen many major changes to the locations that professionals in the industry are working within and, equally, they have likely not been as affected by the demands from employers to return to full-time office work. As a result, there have likely been fewer factors that would trigger a desire to change roles for those working in the sector.

That being said, the fact that other areas are growing at a faster rate than London indicates that some priorities may have changed post-Covid, and reflects that London is no longer viewed as the prime or sole location to secure quality work. Equally, Birmingham’s current rate of live job roles shows that, even though their growth rate is 5%, there is still a high level of demand, with the highest ratio of job posts to professionals.

| LOCATION | PROFESSIONALS | JOB POSTS | HIRING DEMAND |

| London Area | 190,840 (3% increase) | 16,704 | Very high |

| Manchester Area | 22,801 (4% increase) | 2,259 | Very high |

| Greater Leeds Area | 15,937 (4% increase) | 1,179 | Very high |

| Greater Edinburgh Area | 12,318 (4% increase) | 914 | Very high |

| Greater Glasgow Area | 11,415 (6% increase) | 830 | High |

| Greater Bristol Area | 10,879 (4% increase) | 703 | Very high |

| Birmingham | 8,012 (5% increase) | 1,009 | Very high |

| Greater Reading Area | 7,079 (2% increase) | 525 | Very high |

| Greater Oxford Area | 6,904 (3% increase) | 491 | Moderate |

| Greater Liverpool Area | 6,281 (3% increase) | 291 | Low |

Top Employers

Although Amazon has already had a large amount of growth, they also have the highest volume of active job listings of those in the top 10. Given ongoing changes to consumer habits, this is unsurprising; however, they also have the highest attrition rate out of all in the top 10, which paints a complicated picture. While Meta has seen the largest growth by far out of the top 10, their ongoing recruitment rate is low given the number of current job posts that they have live. However, their attrition rate is the lowest, at 6%.

With 3 banks in the top 10, it’s clear that there is an increased reliance on the tech industry as banks become increasingly digital. The last 3 years have seen a significant period of evolution: with heavier usage of online banking globally and a higher volume of scamming being seen, cyber security is a huge priority for banks, so it is natural that they have increased requirements. Lloyds bank is the biggest in the top 10 and has the biggest percentage of growth out of the 3 banks, as well as the lowest attrition rate. On the other hand, HSBC seems to have gotten smaller and has a low number of active job listings. This could potentially be attributed to the ability of international banks such as HSBC to move the locale of their workforce wherever needed with relative ease, whereas the other 2 banks are solely UK-based.

| COMPANY | PROFESSIONALS |

| Lloyds Banking Group | 3,879 (8% increase) |

| BT | 3,401 (4% increase) |

| Amazon | 2,873 (17% increase) |

| HSBC | 2,865 (2% decrease) |

| Tata Consultancy Services | 2,847 (4% decrease) |

| Capgemini | 2,674 (11% increase) |

| IBM | 2,529 (2% decrease) |

| Sky | 2,492 (9% increase) |

| Barclays | 2,149 (3% increase) |

| Meta | 1,962 (76%) |

Fastest Growing Titles

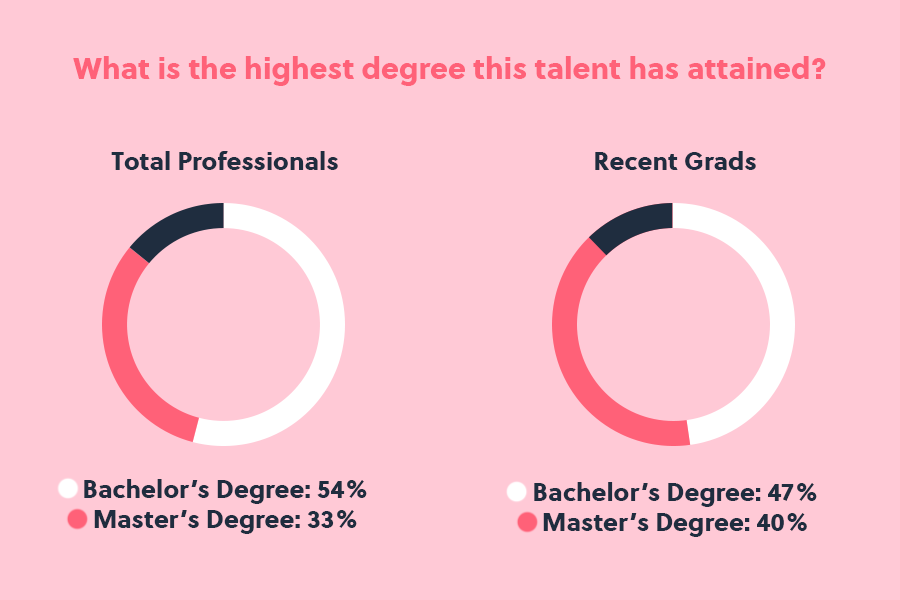

The significance of the ‘Intern’ role topping the leader board of fastest-growing titles in the industry could be accounted for in a number of different ways. As the industry faces a significant skills gap, it could be that internships and placements are being relied upon more heavily as a means for plugging the gap, whilst equally offering the opportunity for vocational experience for entry-level individuals looking to break into the industry. This theory is equally supported by the table below, which shows that more recent graduates are opting to obtain a higher level of degree qualification (masters-level), at 40% of recent grads versus 33% of professionals overall.

Moreover, as businesses expand and teams within the industry grow, it could be argued that larger and more definitive hierarchies are being established- perhaps for the first time- within the industry. The prevalence of more ‘junior’, ‘graduate’, and ‘associate’ titles as some of the fastest-growing in the sector could be a sign of the maturing of the industry; given how quickly technology moves, this would make sense, as more professionals are likely moving into more senior positions within their industry as they have garnered the experience to earn this title. These more definitive distinctions between job levels could highlight the rapid expansion of teams across the digital sphere.

| TITLES | 1 YEAR GROWTH | PROFESSIONALS |

| Software Engineer Intern | 27% | 1,363 |

| Staff Software Engineer | 23% | 1,310 |

| Graduate Software Engineer | 19% | 2,286 |

| Associate Software Engineer | 18% | 1,952 |

| Junior Software Engineer | 18% | 4,221 |

| User Researcher | 18% | 1,358 |

| Senior Product Designer | 18% | 1,691 |

| Junior Business Analyst | 17% | 692 |

| Senior Data Scientist | 16% | 2,164 |

| Senior Product Manager | 13% | 6,420 |

Fastest Growing Skills

Although both React and Python are already well established in terms of the number of qualified professionals with these skills, it is interesting- and perhaps surprising- to note that these are still some of the fastest-growing skills in the industry. Equally, as more and more businesses look to move to the cloud and begin working solely on cloud-based platforms, Microsoft Azure and Amazon Web Services’ presence in the top 10 is unsurprising.

| SKILLS | 1 YEAR GROWTH | PROFESSIONALS |

| React.js | 31% | 31,614 |

| GitHub | 30% | 16,564 |

| Microsoft Azure | 29% | 23,618 |

| Amazon Web Services (AWS) | 26% | 35,900 |

| Docker Products | 24% | 20,867 |

| Python (Programming Language) | 22% | 75,050 |

| Analytical Skills | 21% | 43,745 |

| Machine Learning | 19% | 25,913 |

| Jira | 19% | 35,000 |

| Node.js | 19% | 26,556 |

Top Industries

Although the IT & Services industry still has the highest number of total professionals in the sector, their hiring demand and overall growth are not as high as might previously have been expected. This could indicate that, as the sector’s place in the business world has evolved, these roles have likely adapted to become increasingly in-house as opposed to outsourced, as businesses become increasingly reliant on technology. This could also be indicative of a maturing of the industry, with more and more businesses feeling increasingly confident managing people with tech skills in-house.

Equally unsurprising is Computer Software’s ranking: this would already naturally have been a popular industry for digital and tech professionals to be occupying but given the increased reliance of businesses and the population in general upon digital platforms such as Amazon, Meta, Zoom, and Teams, it is natural that this industry is seeing high demand as our reliance on these services has increased exponentially. On the other hand, the decreased growth of the Telecommunications industry could indicate that, as more and more businesses switch to VOIP cloud-based phone systems, and people are relying less and less on landlines, the industry is no longer seeing the demand it used to.

The Banking industry has a place in the top 3 but has seen below-average growth year on year. This indicates that the industry was already established as a popular industry for professionals in the sector prior to this year. It is worth noting, however, that although we can see below-average growth here, this is not an industry-wide trend, as we have seen earlier in the report that both Lloyds and Barclays have achieved above-average levels of growth. Moreover, the Marketing and Advertising industry is seeing a high level of demand and growth, as the industry now involves more tech than ever before. Equally, it is also adapting as an industry to become more digital in general, with increased reliance on analytics, automation, and machine learning functions.

| INDUSTRY | PROFESSIONALS |

| Information Technology & Services | 92,686 |

| Computer Software | 68,657 |

| Banking | 32,458 |

| Financial Services | 20,652 |

| Telecommunications | 18,646 |

| Internet | 16,616 |

| Government Administration | 15,419 |

| Insurance | 14,036 |

| Management Consulting | 13,646 |

| Marketing & Advertising | 12,783 |

Education & Institutions

The prevalence of The Open University, sitting at the top 10 on the table, is evidence of the enduring and arguably increased popularity of distance learning as an option for qualification for the sector, with many choosing to opt for a more flexible route with less commitment. The popularity of ongoing learning in the sector beyond degree level could also signify that there is a lack of digital or tech-specific qualifications in higher education, and this in turn could contribute to the ongoing skills shortage.

| SCHOOLS | PROFESSIONALS |

| The Open University | 9,274 |

| The University of Manchester | 8,444 |

| UCL | 6,078 |

| University of Cambridge | 6,021 |

| Imperial College London | 5,910 |

| University of Leeds | 5,823 |

| University of Birmingham | 5,753 |

| University of Nottingham | 5,122 |

| University of Oxford | 4,863 |

| Sheffield Hallam University | 4,818 |

Equally, it is interesting to note that those professionals entering the industry are choosing to study associated and relevant degrees that correspond to the industry that they are working within, and professionals are opting to go down a more ‘traditional’ university pathway rather than going straight into the workplace.

With the hiring market showing no sign of slowing down, the next 12 months are set to be just as busy as the previous ones have been. But, with the shortage of talent continuing to impact ability to hire, firms need to consider their offering and the value they can provide to potential new hires who are spoiled for choice of opportunities.