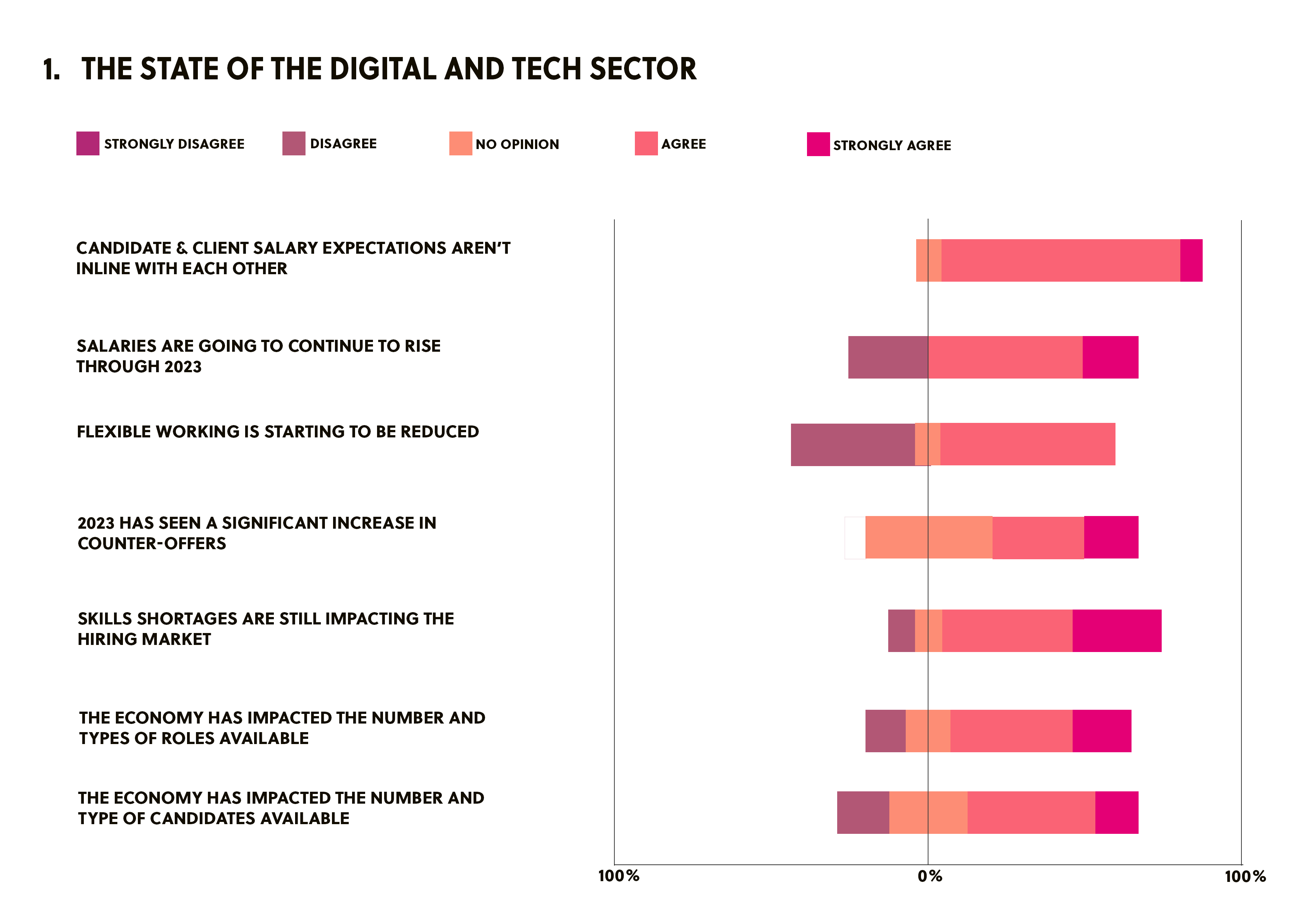

To get a clearer picture of the current lie of the land within the Digital & Tech sector, we asked our consultants to rank the factors that have had the greatest impact on hiring within their industry and to share their personal insights on the current hiring climate within the sector, their experiences operating within it over the first quarter and their predictions for the months that lie ahead.

Overview

Looking back at the first quarter of this year, I think it’s fair to say there have been ups and downs. Thankfully, it finally feels safe to say that the risk of a recession that loomed over all businesses in the Digital and Tech industry is no longer posing the threat that it once was, and confidence in both the economy and hiring will hopefully begin to resume. But, whilst a somewhat restored confidence for businesses is a definite positive, there are still a lot of challenges to hiring that have become prevalent in the first quarter of this year.

The shortage of skills appears to be the greatest impactor across the majority of specialism in the Tech industry, not only because it means there is a shortage of qualified individuals to recruit from, but because the scarcity of talent available is pushing salary expectations higher and higher. As a result of this shortage, hiring managers need to be prepared to pay a premium for the skills they need. Equally important for businesses will be ensuring they have an attractive EVP: remote and flexible working is viewed as the new norm for those who are looking to change roles, and companies that can fail to accommodate this are likely to set themselves back.

“Managing client expectations in a skill-short market has been one of the biggest challenges for me this year…”

Clients are unwilling to pay top-end salaries but are expecting a lot more skills than the market can offer and are being a lot more selective with whom they decide to hire this quarter. Clients are paying more in line with what candidates can offer them, rather than what the market rate is. We will likely see an end to the influx in roles we were seeing since talks of the recession began, as the outlook for the economy is beginning to look more positive. Equally, since fear of a recession has faded, there are now a lot more candidates open to making a move since job security will likely improve. For my particular market, I would say that the individuals I work with tend to value projects and career progression much more highly than money.

Marcus Knapp, Managing Consultant (.Net, Midlands)

“In my work with Solutions Architects, I have noticed contractors tend to be easily persuaded to shift to a role for a higher salary…”

Equally, more and more contractors are wanting to work purely remotely and, since a lot of companies are now requesting hybrid working, this presents a challenge to recruit. The lifestyle and flexibility that working fully remotely offer certainly appeals to most. Within my region and specialist area, I don’t feel that there is a skills shortage. However, I am of course aware that within other areas and specialism in the Digital sector, this is a prevalent issue. Companies are being increasingly cautious with their offering when it comes to the salary they are offering new hires, and they are trying to get as much as they can for as little as possible. This can perhaps be accounted for by the unstable financial climate we have been seeing over the past few months. For example, I was working with one company that were initially looking for 2 individuals to join the business, but then pivoted to try and combine the two positions to save on costs.

Sophia Khan, Principal Consultant (Architecture)

“Since Covid, flexible working has become a norm…”

Hybrid is expected as a minimum by the majority of candidates, and contractors will want remote 90% of the time when working within private contracts. In my view, the biggest thing affecting tech in the UK generally is the shortage of skills. Having said that, in my experience, most of the companies I’ve spoken to who utilised agencies in the last year have had ease of access to candidates due to layoffs: the effect of layoffs within the tech industry in the last 12 months has been significant.

James Redfern, Principal Consultant

“The biggest impact this year has been a lack of understanding about what the impact of the skills shortage means for salaries…”

Skills are becoming harder and harder to find, and the knock-on effect of this is that salaries are climbing as a result. For example, a role that 2-3 years ago may have typically been salaried at £40k per annum would now need to be offered at a minimum of £45-50k in order to entice a candidate to make a move, especially if a candidate is passive.

Finlay Biggs, Recruitment Consultant

Public Sector

“For the first quarter of 2023, we have seen a very unsure market…”

In my experience, it seems that clients have only wanted to take on candidates that hit 100% of the job’s specifications rather than just the most prominent skills on the job description, whereas previously they were more open to training them. The candidates that do meet all of the requirements tend to either be contractors or command high-end salaries. We are often finding ourselves in a Catch-22 situation where clients aren’t prepared to pay contract fees when there have been skills shortages but equally won’t pay the higher bracket salary in spite of this being cheaper than hiring a contractor. We have also seen situations where our clients have thought that candidates were the right fit but have decided to pass on hiring them because of salary expectations. The principal issue here is that the majority of the individuals we work with are actually happy to stay where they are until somebody can offer them exactly what they are looking for, and this is presenting a real challenge to hiring. On the upside, however, we have seen an uplift in interest from clients who are keen to take on contracts in Q2, whereas, in the first quarter of the year, there was a lot of hesitancy and a lack of desire to take any chances. Hopefully, this confidence will continue into the remainder of the year.

Chris Reid, Associate Director, Contracts

“The biggest challenge I am finding in this market is the level of counteroffers we are seeing, with the day rate offered being either higher or outside IR35…”

I am also finding that clients are wanting people to come into the office more; I think this could be a result of businesses needing to capitalise on office usage and trying to make the most of paying high rent during a difficult financial time. Equally, the skills shortage is really affecting my ability to place the correct person in a role, and most clients aren’t offering enough remuneration for the level of skill they need.”

Jemma Smith, Recruitment Consultant

“Over the first quarter of this year, I’ve noticed a significant downturn in the number of jobs being released…”

This is likely a result of funding being spread very thin across the public sector. Public sector rates have always been lower, but we are now seeing some candidates looking to add £50+ onto their standard rates in order to counter the higher interest rates. Others, however, will accept a lower rate of pay in order to secure a long-term contract that will ensure they’re not out of work during the cost-of-living crisis.

I am still able to find plenty of available contractors on the market currently, as it seems that various companies have chosen not to renew their contracts, as contractors will always be the easiest people to let go of when budgets are tight. Lots of public sector roles seem to offer a minimum of hybrid working on their descriptions, however in reality a lot of contractors are still working remotely; it seems that many public sector managers have been remote since the onset of the pandemic and have never fully gone back.