State of the Sector: A Financial Services Sector Report

After a challenging and turbulent 2021, the Financial Services sector is set to see further growth and demand in the year ahead. According to the International Monetary Fund, ‘the global economy is poised to stage the strongest post-recession growth in 80 years’, with global GDP expected to grow by 4.9% in 2022. Already, we have seen a huge increase in the demand for skilled workers: at the tail-end of 2021, the Morgan McKinley winter recruitment monitor reported 40% more financial services jobs available in the fourth quarter of 2021 than in the same period of 2019, prior to the onset of the pandemic and its implications on the market. But, as much as the market has bounced back from the pandemic in terms of demand, the struggle to hire is arguably one of the most prevalent challenges the Financial Services sector has faced in the first quarter of 2022. As Tanya Ott, host and producer of Press Room Podcast, puts it: ‘In the financial services industries these days, it’s either disrupt or be disrupted.’ Businesses will need to steel themselves for the challenge ahead and innovate to stay ahead in a fiercely competitive market.

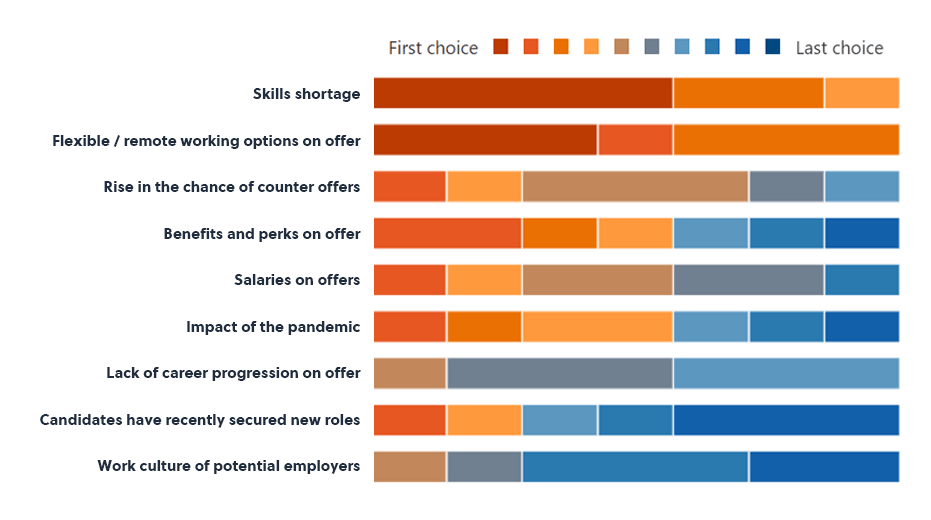

We asked our Financial Services team here at Heat to rank the factors that have had the greatest impact on the current candidate shortage. The results have ranked skills shortage as the greatest impactor, with the hybrid-remote work debate coming in close second. To give further insight into the state of the sector, we then asked our Financial Services team to share their personal insights on the current hiring climate within the sector, their experiences operating within it over the first quarter and their predictions for the new financial year.

What have been the biggest changes to your sector so far this year?

“Generally speaking, the market so far this year has been ruled by the candidate shortage. There have been a large number of resignations and an increasing number of vacancies. We’re also seeing a continued demand for home-working from candidates.”

Dan Gratton: Senior Recruitment Consultant

“The biggest change so far this year has been the lack of experienced and qualified candidates on the market looking for new work. Many of my clients are particularly struggling to find Paraplanners with the relevant experience. A key success has been the maintaining of remote working with many firms, enabling them to widen their searches during a time of candidate shortages.

But, on the flipside, candidates should be prepared for companies potentially looking to move back to office-based work as the predominate mode of working: we are already seeing some businesses requiring employees to go back to the office full time. Clients need to realise they are massively reducing the pool of candidates they can attract by doing this.”

Bobby Spalding: Senior Recruitment Consultant

“The biggest change I’ve seen so far is an increase in candidates feeling more secure in seeking out new roles as we begin to move past all of the problems caused by the pandemic and lockdowns. We are seeing more and more companies offering flexible working and fully remote roles; however, some have returned to expecting in-office work. In my experience, most candidates seem fine with returning to work 100% in the office, as work from home has become less popular this year. Clients are also continuing to embrace video interviews in order to quicken the process, which is essential in the current market; although sometimes this route is causing lack of buy in from candidates.”

Kate Black: Delivery Consultant

What should clients and candidates be prepared for in the year ahead?

“Good candidates that are qualified and experienced are exceptionally hard to come by, and so should not be looked over in the rare case that they do come by. Candidates have more choices than ever now with so many companies looking for top talent all the time, so clients need to act swiftly in their interview process and candidates need to be clear on what their next steps look like. There are strong opinions about flexi working: some firms are very for it and others are very against it. Candidates seem to be looking for flexible working more and more now.”

Alex Russon: Associate Director

“Back-office support vacancies have become a priority for most clients, who have become increasingly busy post pandemic. The knock-on effect is that we are operating in a candidate led market, with those looking for new roles having many more opportunities to consider, especially with so many home-based and hybrid roles available. Clients are now looking to offer more competitive packages in order to retain and attract talent.”

Alex Woodward: Recruitment Consultant

“Clients need to be aware of the simple fact that there are more jobs than there are experienced candidates to go around. The market is incredibly competitive, and candidates will often have a range of interviews on the go at once so are difficult to get firm commitment from. My advice would be to reassess recruitment strategies, ensure your benefits and salary packages are competitive ahead of the typically busier summer recruitment months that lie ahead.”

Lucy Warman: Managing Consultant

Key Take-Aways

The Office versus Remote Work Debate

As evidenced in the responses of our consultants, the relaxing of government restrictions and advice on office-working has opened up a debate on the future of work processes with the sector. According to Deloitte, ‘nearly 70% of respondents in our survey say they expect their organisation to pivot to hybrid work’. But in spite of this, many businesses are insisting on a return to in-person work. After more than 2 years of working remotely, and enjoying the flexibility this offers, many candidates are reluctant to return to the office full-time and are therefore declining roles that stipulate office work; equally, those businesses who are now enforcing a return to the office are seeing their existing employees jump ship for roles that can offer remote or hybrid work patterns. The knock-on effect of this for employers is a struggle to recruit: those employers that can be flexible and offer the option for remote will certainly widen the pool of talent they can recruit from and make themselves more attractive to prospective new talent.

Candidate attraction is key

In the current hiring climate, being competitive is key. The benefits, salaries, and methods of attraction that were once sure-fire have rapidly become outdated, and clients will need to consider what more they can do in order to attract in-demand talent. We have seen a definite shift in the desire of candidates to work for a business that aligns with their own values and shows a strong sense of corporate social responsibility. The Deloitte report suggests that clients ‘can give jobs more meaning and purpose beyond commercial outcomes by expanding them into areas such as social equity or climate change.’ There should also be a consideration of culture: financial services businesses now have an opportunity to overhaul and redefine their culture as the return to office-based work becomes increasingly normalised. Culture is a key consideration for many candidates, with 45% of candidates within the UK selecting company culture as a top priority when choosing a new role according to data from the LinkedIn Global Talent Trends 2022 report.

Moreover, in order to combat the shortage further, it’s important for businesses to think outside the box. This may encompass allowing for remote working and flexibility to hire for the skills and level of experience required or considering new avenues for employment. According to Deloitte, companies should consider ‘expanding talent pools to new geographies or focusing on parents re-entering the workforce.’

In conclusion

Those trends that ruled the hiring market throughout much of Q1 look set to continue into the year ahead. With candidates in short supply, vacancies on the up, and these many hurdles to contend with, this may seem like a daunting prospect. It’s more important than ever that companies pay attention to the trends in the market and be willing to adapt to keep up.

It’s clear that salaries are on the rise, but companies still have other options to retain their talent. By re-examining their recruitment processes and strategies, as well as reviewing and enhancing their benefits options, companies can make themselves more attractive to candidates who are looking to secure a new position.

For candidates, now has never been a better time to make a move. As we move towards the latter end of the pandemic, and confidence in the stability of jobs grows, candidates are in an extremely healthy position to make a career change that could garner them greater opportunity for growth and success, as well as a host of competitive perks and benefits. Financial Services businesses are set to see exponential growth over the coming year, but they will need to bolster their recruitment efforts in order to secure the additional resources to keep up with the growing demand.