As part of the series of insights around our 2023 Sales Salary Survey, we have analysed the current UK Sales hiring market to understand the trends, challenges and opportunities for the year ahead. Read on for our UK market insights and overview.

Overview

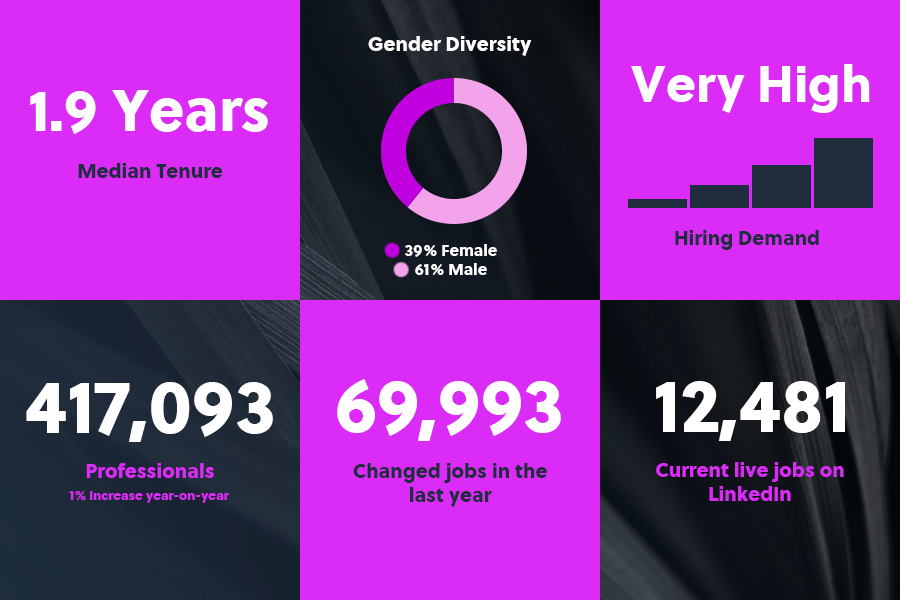

In the last year, the Sales sector has seen extremely high demand for hiring, but very little actual growth. In terms of the number of professionals who entered the market in the last year, the percentage is very low, at only 1%. Equally, we can see that there was some significant movement in the market, with approximately 17% of professionals changing roles in the past year.

The median tenure of 1.9 years among professionals in sales indicates that a high volume of people have changed jobs since the onset of the pandemic and various lockdowns, at the time when ‘the great reshuffle’ period was most prevalent. It is unsurprising, therefore, to see the number of professionals choosing to make a change, given how buoyant the employment market has been. It is likely that the pandemic has had an impact on the length of median tenure in the sector, as many people’s priorities changed post-covid, and ‘the great resignation’ led to an unprecedented rise in the number of professionals opting to make a career move industry-wide.

Top Locations

We have seen a fairly consistent picture in terms of levels of growth and change across the country, ranging between a 0-2% level of growth. This indicates that across the nation, all locations are having difficulty growing. It is likely that the shortage of talent that is being felt across the board in the industry is having an impact on the ability of any location to grow significantly or sustainably. This challenge seems set to continue into 2023 and beyond. Notably, Bristol has a very high level of demand and a lot of live jobs, but their growth is at 0%, indicating significant challenges in hiring.

| LOCATION | PROFESSIONALS | JOB POSTS | HIRING DEMAND |

| London Area | 114,446 (1% increase) | 4,605 | Very high |

| Manchester Area | 21,889 (2% increase) | 714 | Very high |

| Greater Leeds Area | 14,758 (1% increase) | 419 | Very high |

| Greater Glasgow Area | 8,558 (2% increase) | 173 | Low |

| Birmingham | 7,006 (2% increase) | 333 | High |

| Greater Bristol Area | 6,658 (0% increase) | 204 | Very high |

| Greater Leicester Area | 6,528 (2% increase) | 130 | Moderate |

| Greater Liverpool Area | 6,439 (2% increase) | 154 | Low |

| Greater Sheffield Area | 6,360 (1% increase) | 120 | Moderate |

| Greater Cheshire West and Chester Area | 5,936 (0% increase) | 64 | High |

Top Employers

In terms of companies who are employing the bulk of professionals in the sector, the levels of growth seen by Amazon are unsurprising; given the diversity of services that they now offer, the change in lifestyle and purchasing habits of the general population post-covid, the changing needs of businesses and rising popularity of moving to cloud-based platforms and the rapidly evolving and diverse range of digital requirements, their exponential growth is to be expected.

On the other hand, we can see that there are varied results when it comes to the banking industry: while HSBC and Lloyds have both seen increased growth, Barclays has instead shrunk by 6%. Equally, although HSBC have decreased in their total staff, they still have a growth level of 7%, indicating that they are still investing in growing their teams, and are seeing a relatively low rate of attrition also.

| COMPANY | PROFESSIONALS |

| BT | 1,113 |

| HSBC | 515 |

| Amazon | 424 |

| City Electrical Factors | 423 |

| Softcat plc | 389 |

| Barclays | 339 |

| CCS Media Limited | 337 |

| Lloyds Banking Group | 327 |

| Microsoft | 321 |

Fastest Growing Titles

The rapidly evolving landscape of the market, exacerbated by the onset of the pandemic, seems to have led to a widespread restructuring of teams and breakdown of roles and responsibilities. As a result of this, it seems that there are a wider variety of roles and titles on the market. Job titles appear to become more detailed, more niche, and more specialist; for example, ‘Strategic Account Manager’ and ‘Territory Account Manager’. Arguably, this could be as a means to sell the benefits of the roles in question, and to indicate how specialist they actually are, as the breadth and diversity of the ‘Sales’ industry increases.

Sales Development Representative as a title has grown massively over the past year; this could be accounted for due to the title’s popularity within the tech sphere in particular. The tech market is a rapidly expanding one, and is showing no signs of slowing down. With the level of hiring we are seeing, it is no surprise that the title is becoming increasingly popular and standing out. Equally, the title itself references the essence of the job much better: it literally talks about developing the sale, which is what entry-level roles do most. The high volume demand is therefore unsurprising.

Equally, the rising popularity of the ‘Group Commercial Director’ title can be explained due to the increasing number of investors who are implementing this function into their business, and will then go on to acquire others. Investors will naturally want to fund businesses within growing industries, so there is a high chance that the GCD role is here to stay. It alludes to someone heading up matrix sales management functions where there are several businesses rolled up into one parent company. The GCD role functions to ensure cross sell strategies are maximised, which is a highly prevalent skill currently: in today’s market, every business is trying to retain and grow clients, rather than just focusing on winning new ones.

| TITLES | 1 YEAR GROWTH | PROFESSIONALS |

| Sales Development Representative | 40% | 4,594 |

| Junior Account Manager | 20% | 1,040 |

| Senior Sales Director | 17% | 658 |

| Associate Director of Sales | 10% | 311 |

| Group Commercial Director | 7% | 714 |

| Strategic Account Manager | 7% | 1,991 |

| Regional Sales Director | 6% | 1,712 |

| Global Sales Director | 5% | 814 |

| Territory Account Manager | 4% | 530 |

| Business Development Lead | 4% | 893 |

Fastest Growing Skills

The highest growth skill (year-on-year) in the top 10 is CRM, at 6%. This could indicate that businesses within Sales now have an increased reliance on technology and are making the move to cloud-based systems as part of their business model, which means there is an increasing need for digital competency and skills from Sales professionals.

| SKILLS | 1 YEAR GROWTH | PROFESSIONALS |

| Sales Management | 3% | 111,448 |

| New Business Development | 5% | 91,512 |

| Business-to-Business (B2B) | 5% | 55,014 |

| Customer Relationship Management (CRM) | 6% | 42,348 |

| Key Account Management | 1% | 41,443 |

| Recruiting | 4% | 36,579 |

| Sales Operations | 3% | 36,465 |

| Sales Processes | 1% | 35,132 |

| Direct Sales | 4% | 33,734 |

| Business Planning | 1% | 29,813 |

Top Industries

Some of the most notable growth in terms of industries is undoubtedly Computer Software at an increase of 7%; this mirrors trends we have seen within the Digital & Tech sector across the year, as there is increased demand for new technology and software to be implemented in businesses, given the rapidly changing business practices we have seen across the board in recent years and the reliance on digital systems and software for business continuation.

On the other hand, we can see that the growth of professionals in the IT Services industry isn’t anywhere near as high, even though it still has the highest total number of professionals. Equally, as we saw in our analysis of the Digital and Tech sector, IT appears to be seeing a shift as it becomes more of a core business function rather than an outsourced project or add on; therefore, the lack of significant growth in this industry is unsurprising.

Looking at the Marketing & Advertising industry, we can see they are at a rate of growth only slightly above-average at 2%. This could indicate that there has been an increased focus on businesses relaunching and repositioning themselves in the market post-pandemic. It might therefore be the case that this is an area that is slightly more likely to be outsourced to an external agency, as it feels riskier to hire permanent staff for this role in the current climate.

Equally, the decrease in growth of the Telecomms, Automotive and Retail industries comes as no surprise, as demand has undeniably decreased for these industries. Moreover, these all fit into the bracket of industries that have seen a seismic shift post-covid; for example, people using their car for only half of the week, the rise in low emission zones in city centre, and a rising prevalence of environmental consciousness in the general population. The decreasing demand for Telecomms services ties in with the rising popularity of cloud-based and VOIP systems for businesses, whilst retails decrease is in line with the rising popularity of online-shopping and changing consumer habits.

The 3% increase in the Staffing and Recruiting industry indicates that this is an area that is growing, however the industry also has more live jobs than any other, in spite of it being a smaller area. This indicates that businesses are struggling to find talent using internal teams, and are therefore needing to rely more on specialist recruiters in the difficult hiring market. We have seen that HR professionals have increasingly had to take on recruitment responsibilities, this is usually one of the first functions that is moved externally and outsourced from a HR perspective. Interestingly, Staffing and Recruiting is also bucking the trend in terms of gender diversity according to this data, at a rate of 51% female and 49% male. This is an encouraging trend, are more gender balance in this area in particular will arguably lead to a better balance of staff being recruited, and is of benefit to businesses who might ordinarily struggle to recruit diverse talent.

| INDUSTRY | PROFESSIONALS |

| Information Technology & Services | 28,773 |

| Marketing & Advertising | 25,649 |

| Computer Software | 18,472 |

| Construction | 17,743 |

| Financial Services | 12,868 |

| Telecommunications | 12,505 |

| Automative | 12,435 |

| Retail | 10,898 |

| Staffing & Recruiting | 10,726 |

| Banking | 8,406 |

Education

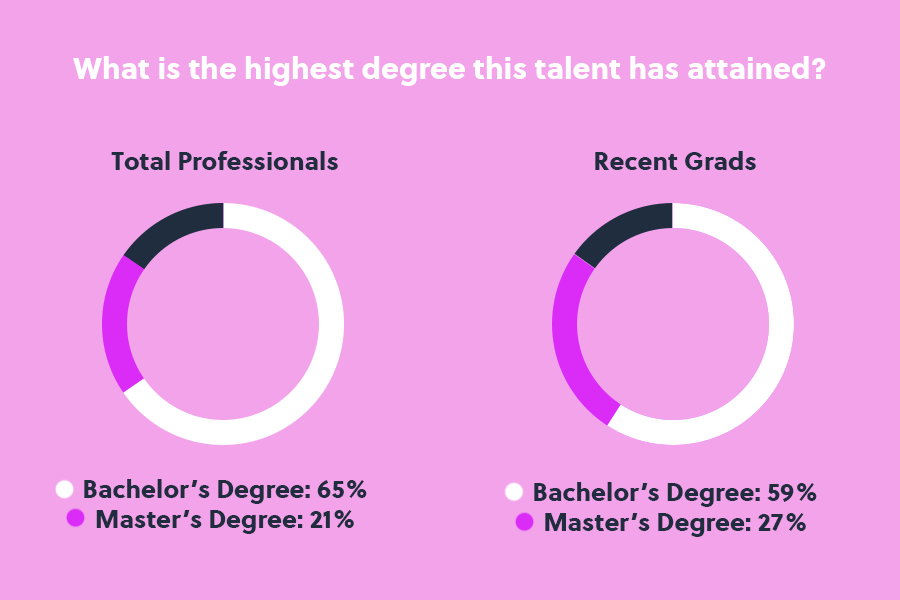

Interestingly, when comparing recent graduates to the professional body in the industry as a whole, we can see that more people have chosen to stay on at university in order to obtain a masters degree. This could be indicative of a reluctance to head straight into the world of work, perhaps due to the instability of the current jobs climate and the difficulty many are facing in securing a position. Or, perhaps because so many people have obtained a Bachelor-level degree now, new graduates will need to obtain a masters degree in order to stand out.

The wide range of subjects and disciplines that Sales professionals have come into the profession from is indicative of the diverse background of people within the talent pool, and the diverse range of skills that these professionals have the potential to possess. This is backed by commentary from our Associate Director of Sales Stephanie Bowers, who has advised Sales businesses to prioritise hiring professionals based on their attitude, as opposed to solely requiring a specific level of experience, background or skillset.

| FIELDS OF STUDY | PROFESSIONALS |

| Business & Commerce | 18,698 |

| Business Administration and Management | 17,138 |

| Marketing | 11,693 |

| Economics | 8,542 |

| Mathematics | 8,478 |

| History | 8,143 |

| English Language and Literature | 7,656 |

| Psychology | 6,228 |

| Geography | 5,317 |

| Business, Management, Marketing, and Related Support Services | 5,274 |

The prevalence of The Open University, sitting at the top 10 on the table evidence of the enduring and arguably increased popularity of distance learning as an option for qualification for the Sales sector, with many choosing to opt for a more flexible route of L&D with less commitment. Equally, as there is no official body for Sales qualifications, the diversity of institutions and disciplines is unsurprising.

| SCHOOLS | PROFESSIONALS |

| The Manchester Metropolitan University | 3,260 |

| University of Leeds | 3,221 |

| The Open University | 3,186 |

| The University of Manchester | 3,034 |

| Nottingham Trent University | 2,955 |

| Sheffield Hallam University | 2,816 |

| Leeds Beckett University | 2,561 |

| University of Birmingham | 2,285 |

| University of the West of England | 2,112 |

| Northumbria University | 2087 |

With the hiring market showing no sign of slowing down, the next 12 months are set to be just as busy as the previous ones have been. But, with the shortage of talent continuing to impact ability to hire, Sales businesses need to consider their offering and the value they can provide to potential new hires who are spoiled for choice of opportunities.